Explaining Pre-Need Insurance

Pre-need funeral insurance is a unique product designed to fund a funeral service agreement between you and the funeral home of your choice. Many funeral homes choose to partner with USAlliance to protect your funds. When the time comes and the funeral home has provided their services, the funds are paid directly to the funeral home for expenses.

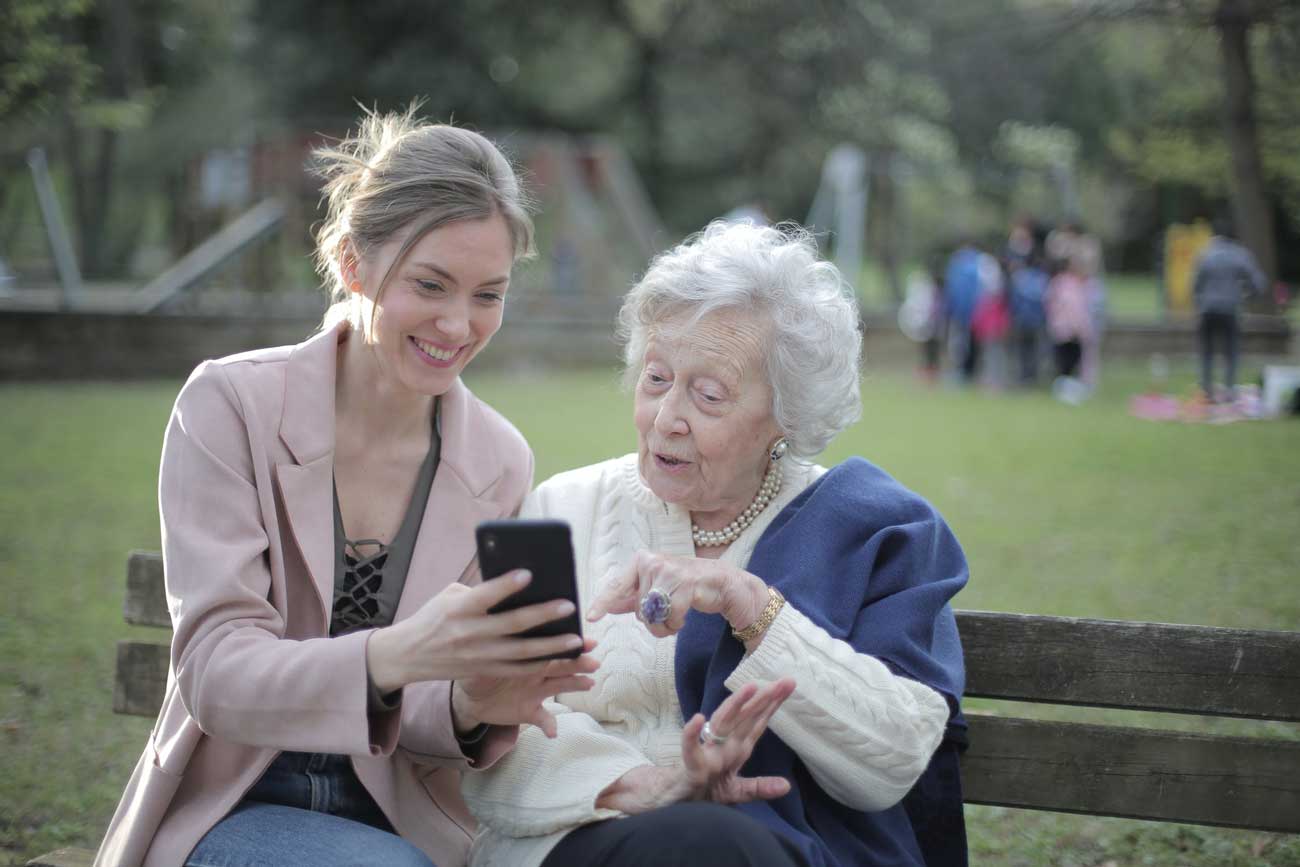

Remove the decision-making burden

Removing the decision-making burden from your loved ones helps build family unity and support during a difficult time.

A more meaningful celebration of your life

Making the decisions ahead of time can save money and preserve your memory with the celebration you want.

Get your questions answered now

Speak To Our Team

Many people may not realize what final decisions need to be made until they lose a loved one and find themselves overwhelmed. You can help alleviate the stress by taking the time to spell out your wishes clearly, ahead of time. Do you want a loved one to face the stress and uncertainty of creating a celebration that represents you? The decisions could be emotionally and financially exhausting if not made in advance. Advance planning (pre-arranging) allows you to help guide your loved ones when they need it the most.

What Does It Mean To Pre-Arrange A Funeral?

Pre-arranging a funeral is an opportunity to ensure that your celebration of life is as YOU want it to be. You choose:

Location

Where the services will be held, and where your final resting place will be. You choose.

Merchandise

This may include caskets, urns, outer burial containers, jewelry, and folders, just to name a few. You choose.

Services

You decide what music will be played and whether there is transportation for the pallbearers, along with many other decisions. You choose.

Benefits Of USAlliance Pre-Need Insurance

The decision to pre-arrange and pre-fund a funeral is one of the most thoughtful gifts one can give. What are the other benefits of pre-arranging?

You can save money

Grieving family members often make quick and more expensive decisions when they don’t know your wishes. Your family could save money simply because you took a moment to choose the service YOU want.

It removes the decision-making burden from your grieving loved ones

The emotional stress after losing a loved one may lead to unnecessary disputes and family disunity. Some of the “simplest decisions” can cause lasting heartache between loved ones. Removing the decision-making burden from your loved ones helps build family unity and support during such a difficult time.

Policies are 100% transferable

Funds set aside in a USAlliance pre-need policy can be assigned to the funeral provider of your choice. If the situation changes and you decide to change funeral providers, you are free to do so. You are in control.

It provides a more meaningful celebration of your life

Time is not on the side of a grieving family. Financial decisions are required to be made in a short period of time. When there is no pressure of time or the sorrow of losing a loved one, making the decisions ahead of time can save money and preserve your memory with the celebration YOU want.

Policy grows with interest

Once the funds have been set aside in a pre-need policy with US Alliance, the policy will grow, to help offset the rising cost of funerals.

Your funds can become a protected asset (for Medicaid purposes)

When irrevocably assigned to the funeral home of your choice, your funds will be protected if you need to apply for state assistance (subject to state law).

Payment plans are available to fit your financial needs

We offer payment plans for 3, 5, or 10 years for those who need to spread out the cost over time. Our goal is your peace of mind within your budget.

Premiums will never increase

As long as premiums are paid on time, your policy will not be canceled.

No one is denied a policy due to health reasons

Answers to the health questions only affect the benefit amount within the first 30 months of a multi-premium policy.

You choose how to be remembered

Time is not on the side of a grieving family. Financial decisions are required to be made in a short period of time. When there is no pressure of time or the sorrow of losing a loved one, making the decisions ahead of time can save money and preserve your memory the way you choose.

Spend time with family, not making difficult decisions

The emotional stress after losing a loved one may lead to unnecessary disputes and family disunity. Some of the “simplest decisions” can cause lasting heartache between loved ones.

Your Next Steps

1. Get a quote

If you haven’t done so already, this is a great way to get an idea of how much coverage will cost (spoiler: it’s probably more affordable than you think). Our team is ready to help.

2. Visit with us

Our team at USAlliance or a partner funeral home will reach out to you to help determine the amount of coverage that is right for you. Our team will assist you in completing the simplified application for your guaranteed acceptance policy.

3. Start your coverage

That’s it. You’re done. You can celebrate and focus on your life’s priorities knowing that you are covered and have a direct line to your team. At USAlliance, we strive to be there to help you through the process of getting the coverage you need and your family deserves.

Designed for tomorrow. Available today.

We can help. Learn how.

HOME / Pre-Need